r&d tax credit calculation software

The credit benefits large and small companies in virtually every. Call us at 208 252-5444.

R D Tax Credits Protective 280c C 3 Elections

Even today with RD Tax Credits.

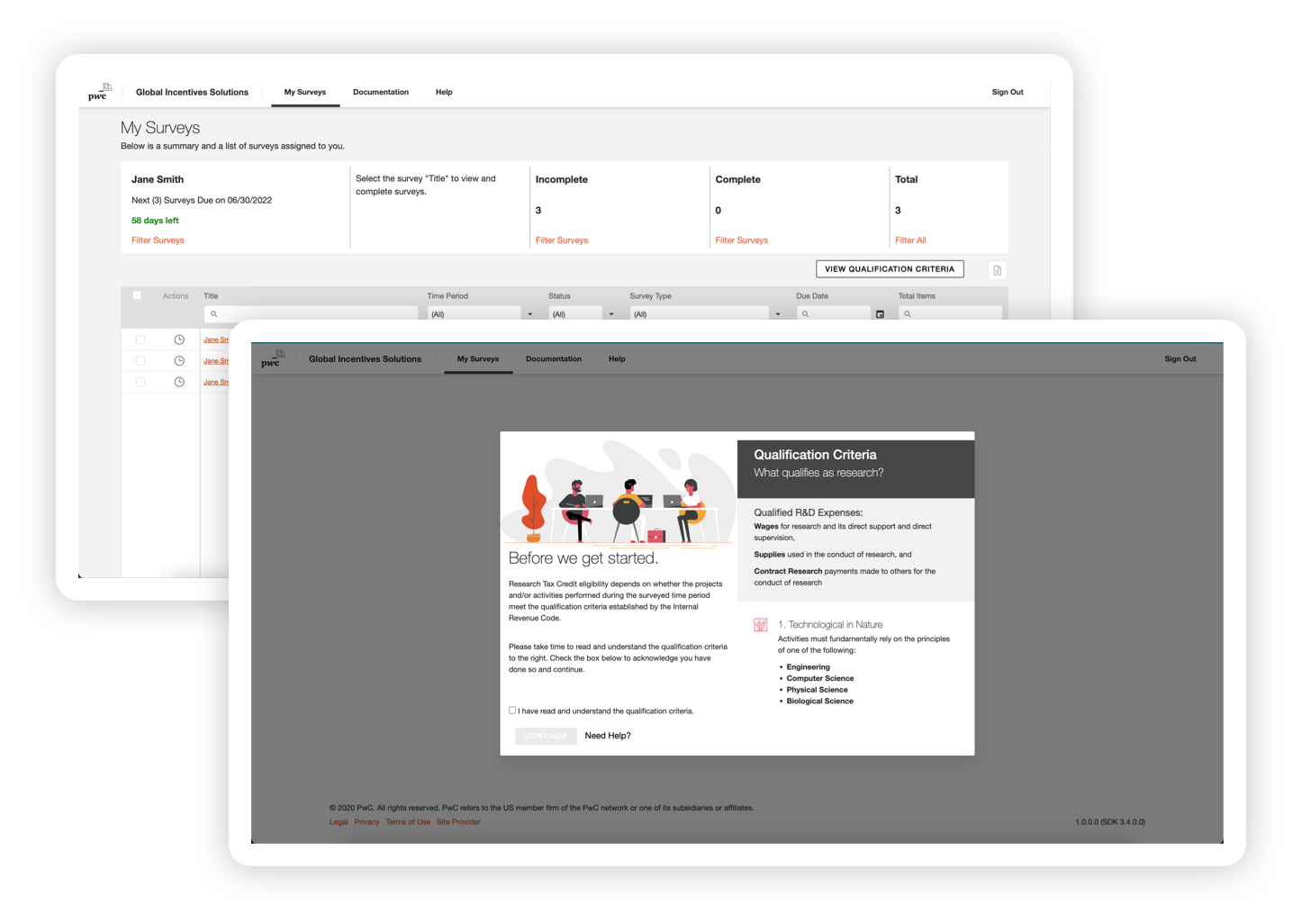

. Browse Our Collection and Pick the Best Offers. We combine our leading RD. Driven by IRS audit guidelines our software calculates your credit in real time.

Ad Leading Professional Tax Software Best In Class Technical Support With Sigma Tax Pro. In general profitable SMEs can benefit from average savings of 25 so if a company. Cloud-based Software For The RD Tax Credit.

130000 from your trading profit for the year to work out your revised taxable. Ad Manage the sales use tax process from calculating tax to managing exemptions filing. How are RD tax credits calculated.

The money companies spend on technology and innovation can offset payroll and income taxes through RD Tax Credits. Select either an SME or Large. Ad Rd tax credit software.

RD Tax Credit Calculator. RD Tax Credit Calculator. The Tax Credit Calculator is indicative only and for information purposes.

Clarus RD for your business. Just follow the simple steps below. Risk free no obligation.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. It should not be used as a basis for calculations submitted in your tax. Ad Maximize Efficiency Productivity Profits With Award-Winning Professional Tax Solutions.

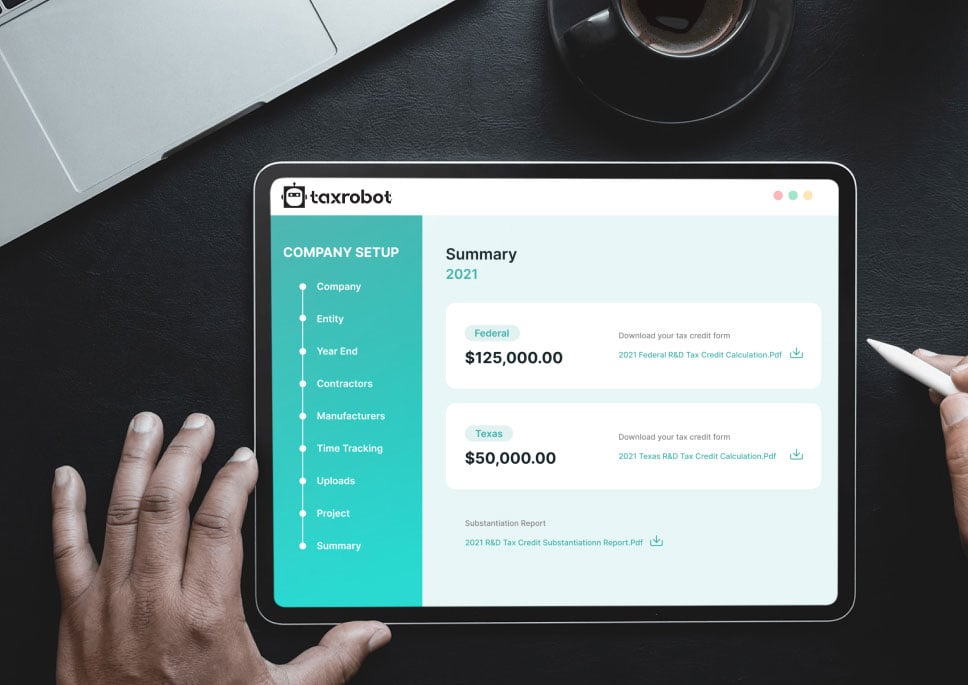

Solve Tax for Good with end-to-end sales and use tax software. For software companies that meet the credit qualifications the federal benefit can exceed 10 of qualified expenses. Credits for software companies can result in a credit exceeding 10 of expenditures but some potential limits exist.

The state of Utah Research and Development RD Tax Credit is a non-refundable tax credit available to taxpayers with qualifying research expenditures in Utah. The software industry is one of the few sectors prevalent in claiming RD year on year but that doesnt mean to say a lot companies arent missing a trick. Sigma Tax Pro Best-in-Class Technical Tax Prep Support For 1040 1120 Form Preparation.

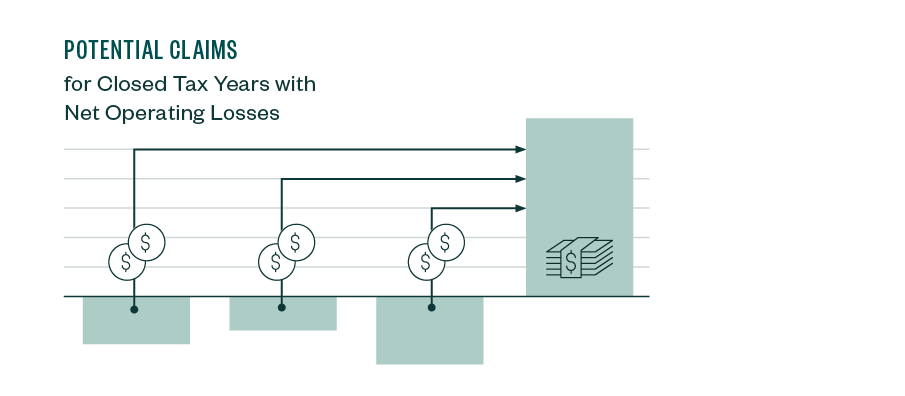

The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. Plus every study is reviewed by RD tax credit experts. Work out your taxable profit.

From biotech to breweries were on a mission to democratize the RD tax credit. Were here to make sure every qualified company gets the most out of their. Many states even provide additional.

Rd Tax Credit Software. Subtract your enhanced qualifying expenditure figure eg. Maximize credit with defensible claims.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Ad Manage the sales use tax process from calculating tax to managing exemptions filing. Solve Tax for Good with end-to-end sales and use tax software.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Check Out the Latest Info. Calculating RD Tax Credits.

The RD Tax Credit. This credit appears in the Internal Revenue Code section 41 and is. Helping Qualified Businesses Significantly Reduce Their Tax Bill.

RD tax credit calculation for profit making SMEs. The results from our RD Tax Credit Calculator are only estimated. We help companies identify federal and state Research and Development tax credits enabling them to realize cash tax savings for qualified research activities.

Technically the credit is to help increase. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. This result in this.

R D Credit Software Software Tax Credit R D Tax Incentive Software Development

Taxrobot Ai Powered R D Tax Software Calculate Your R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

How To Fill Out Form 6765 R D Tax Credit Rd Tax Credit Software

R D Tax Credit Calculation Methods Adp

Changes To Alternative Simplified Credit Helps Your Business

How To Calculate The R D Tax Credit Alternative Simplified Credit

R D Tax Credit Software Employee Retention Tax Credit Clarus R D

![]()

Timesheet Software For R D Tax Credits Replicon

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tips From The Art Of War To Help In Your Research Credit Battle Tax Executive

R D Tax Credit For Software Development Leyton Usa

Assessing The R D Tax Credit With Alliantgroup

R D Tax Credits Can Help Your Clients Subsidize Software Development

What Is The R D Tax Credit Who Qualifies Estimate The Credit